Beautiful Tips About How To Get A W 9 Form

Exempt recipients to overcome a presumption of foreign status.

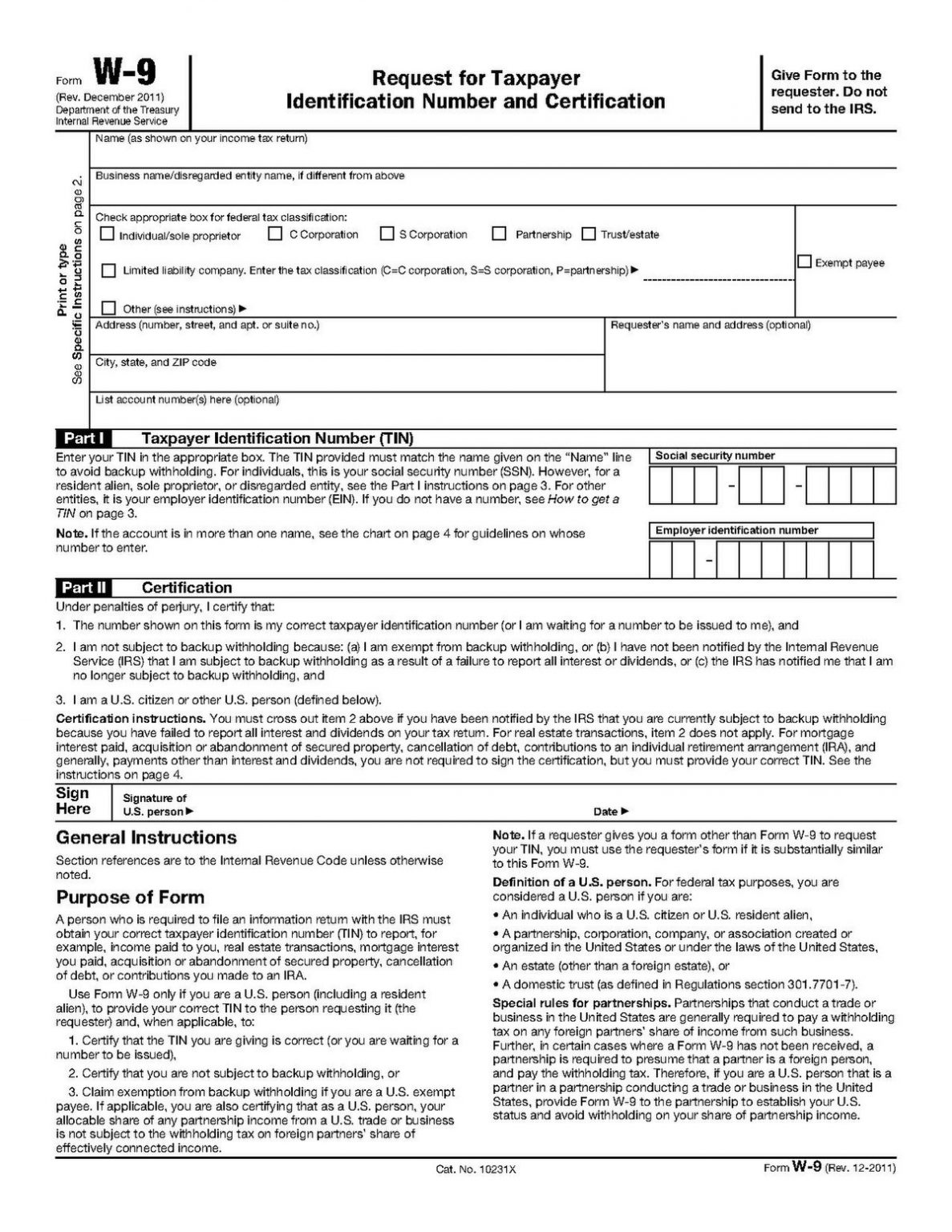

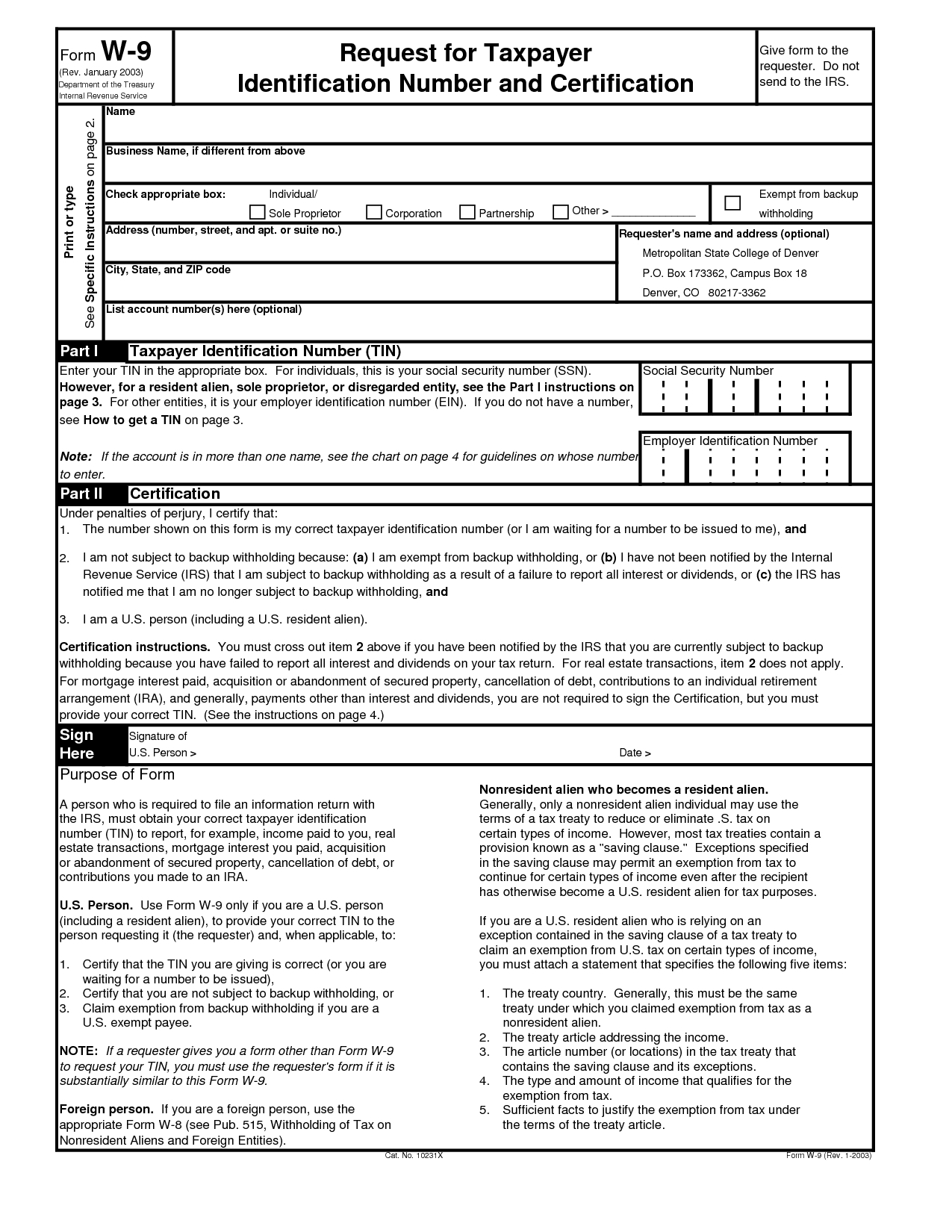

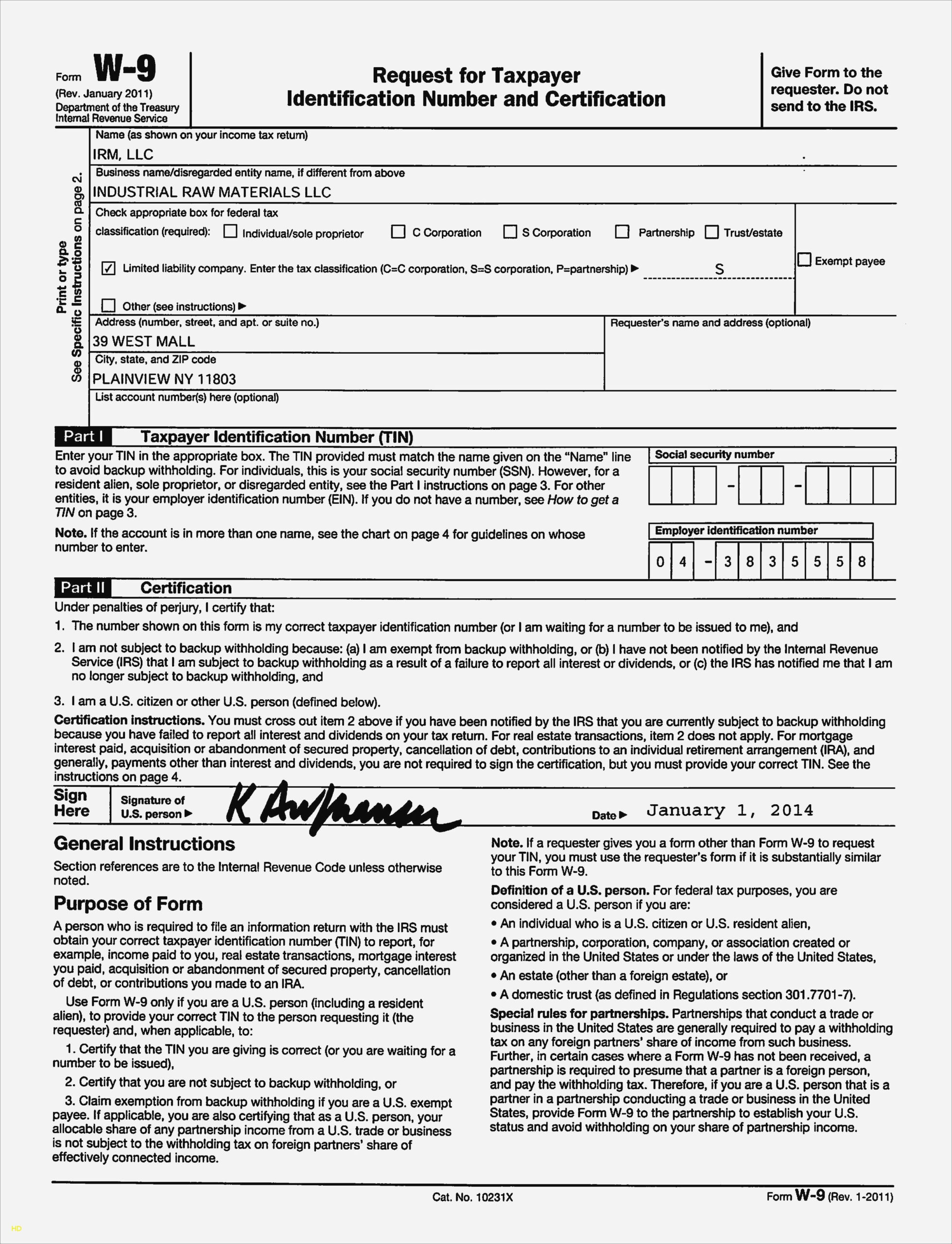

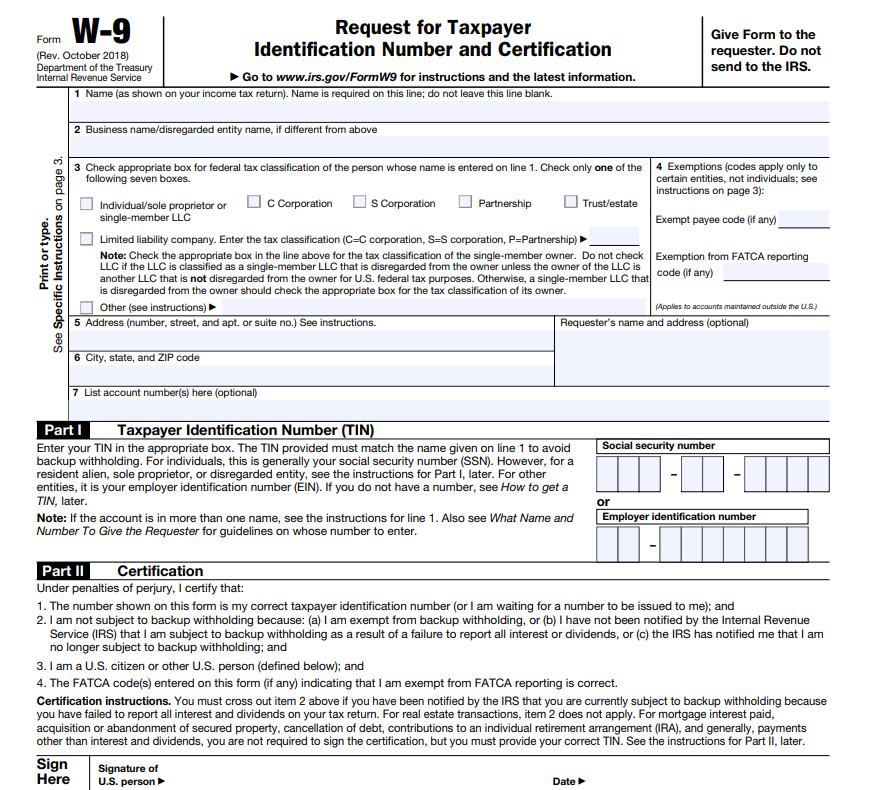

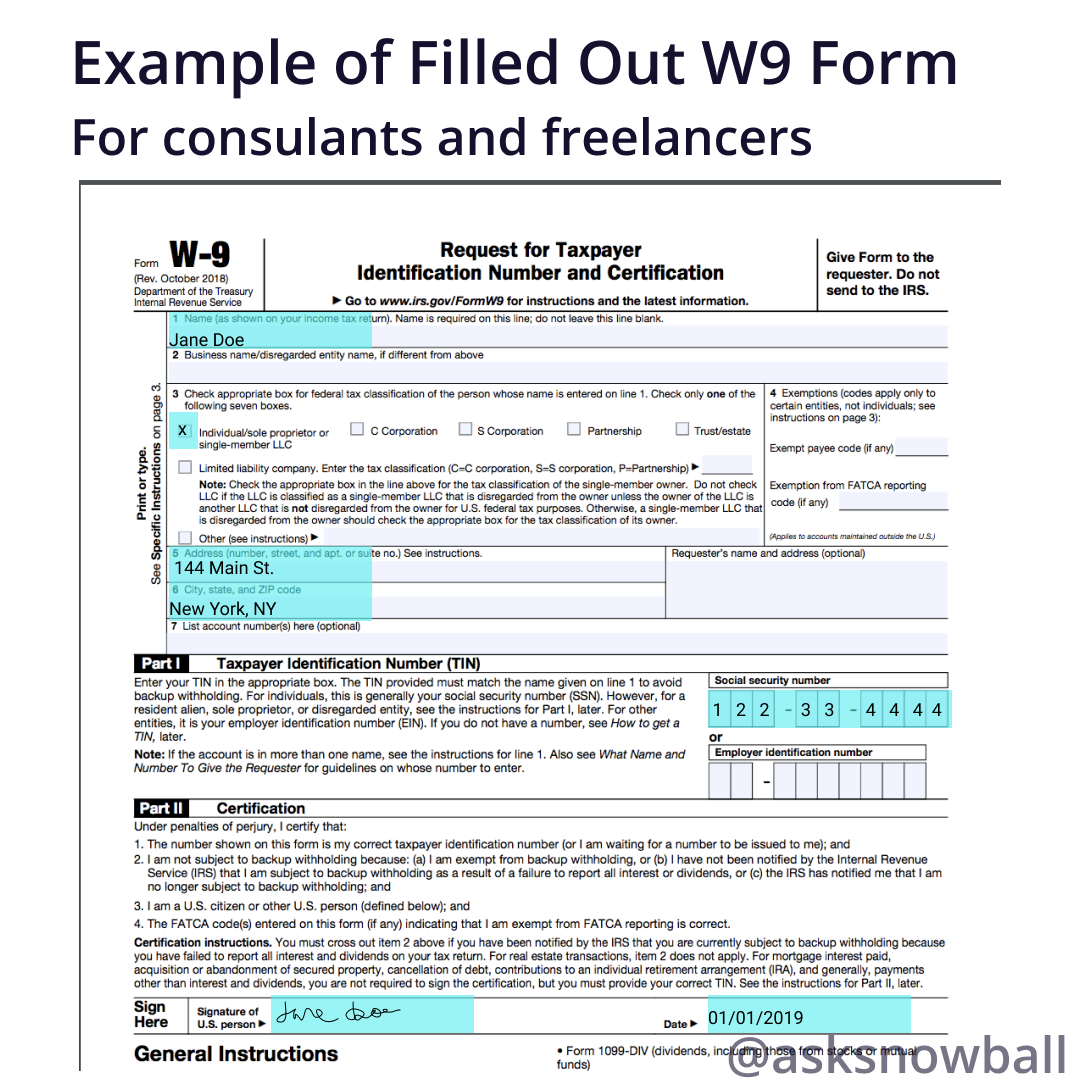

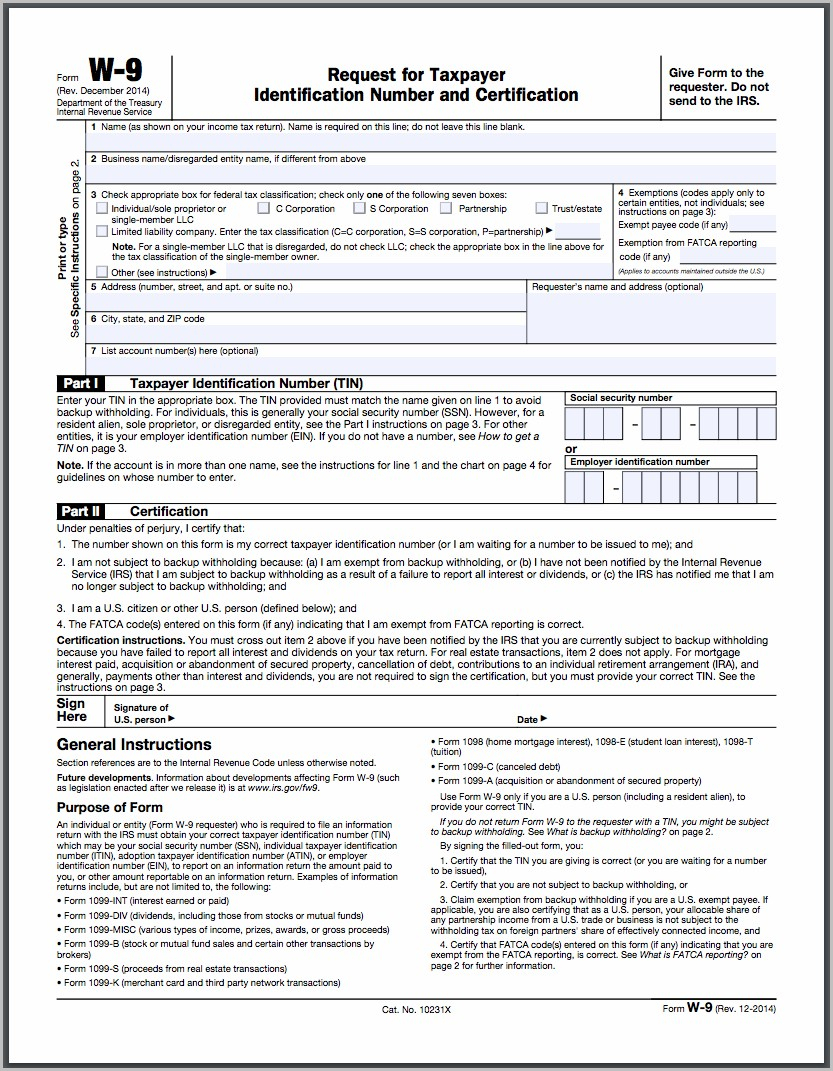

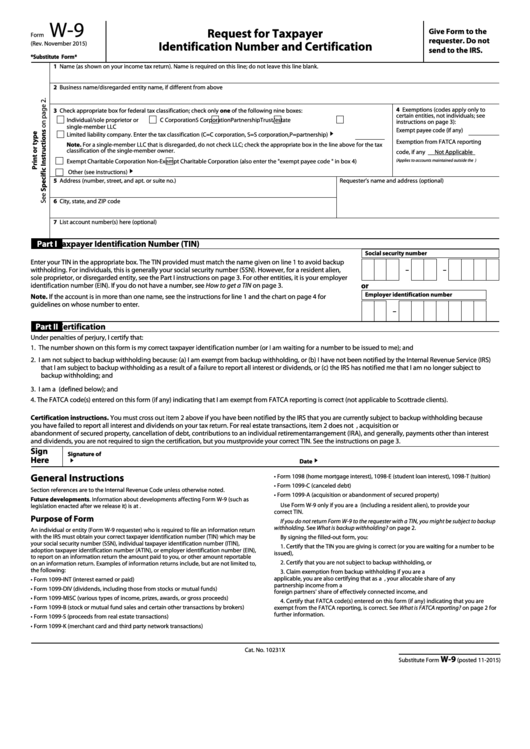

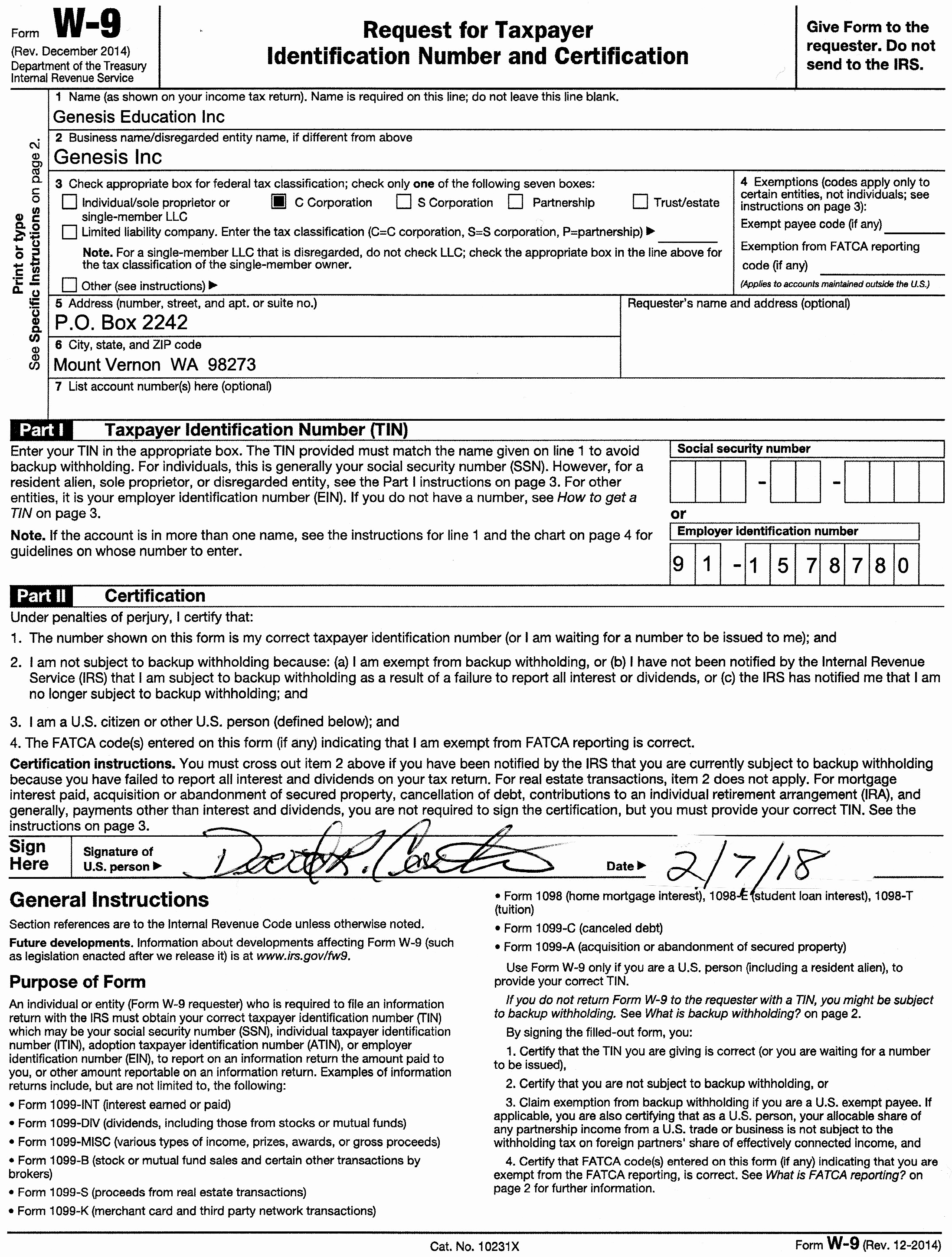

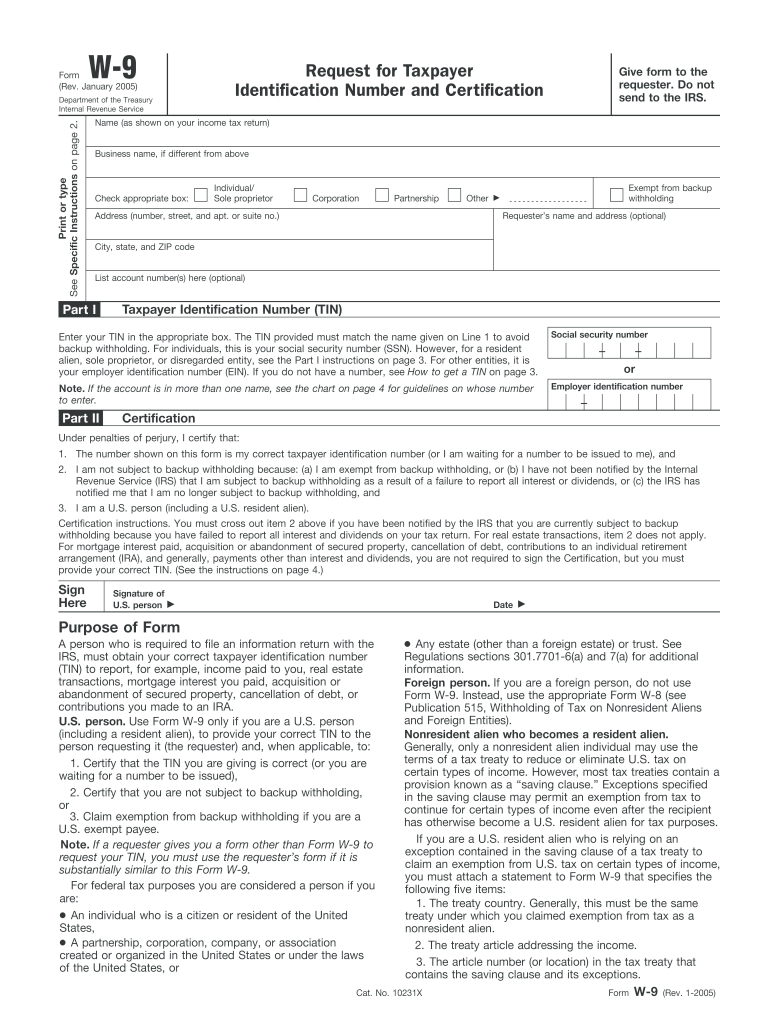

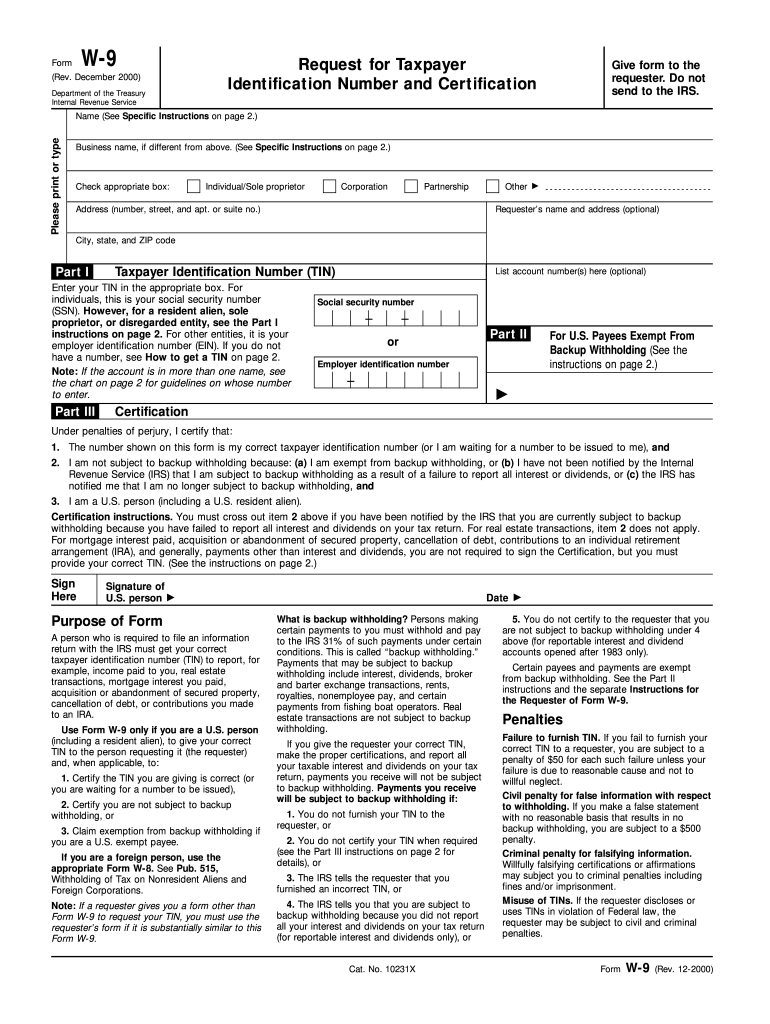

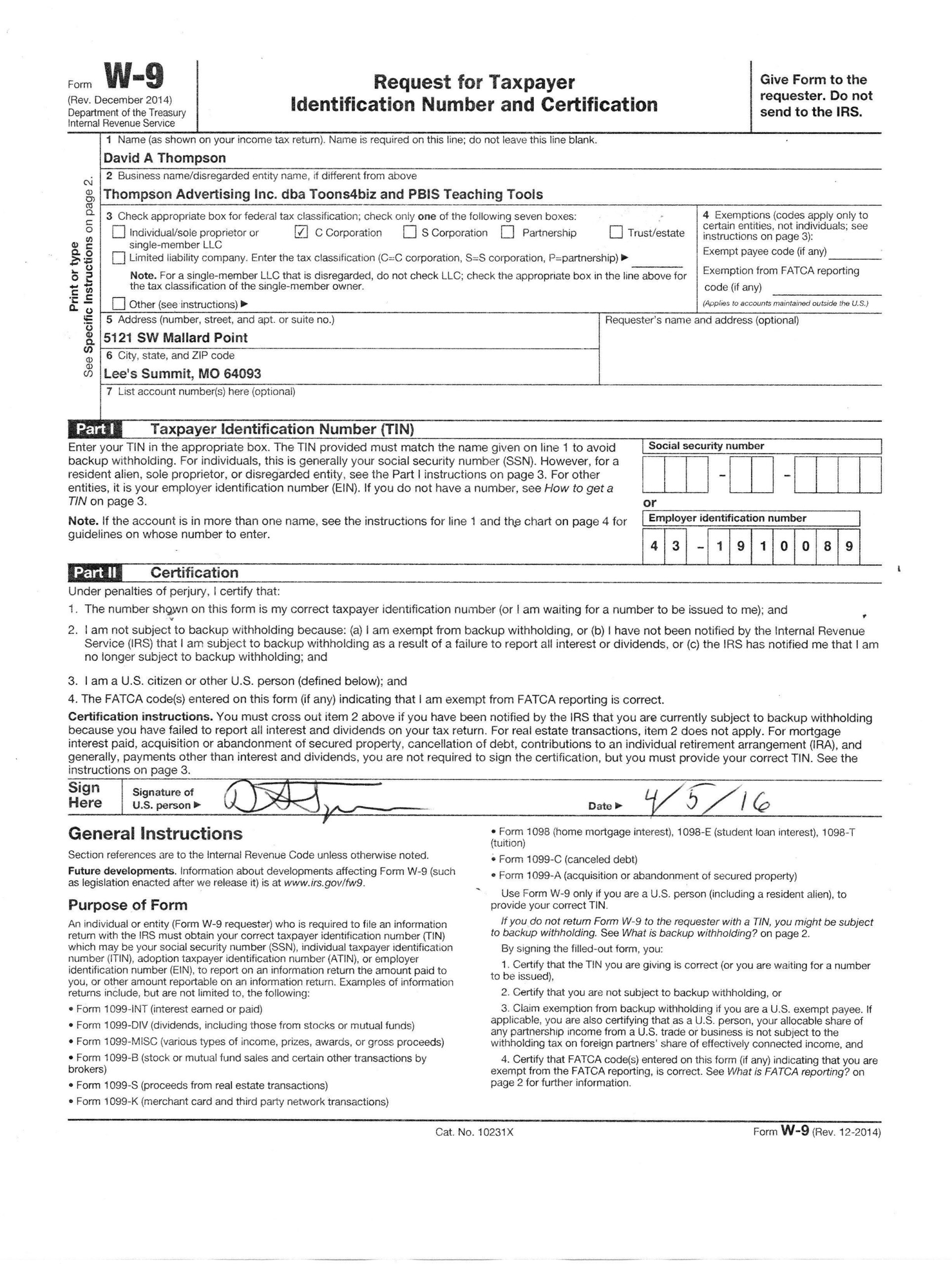

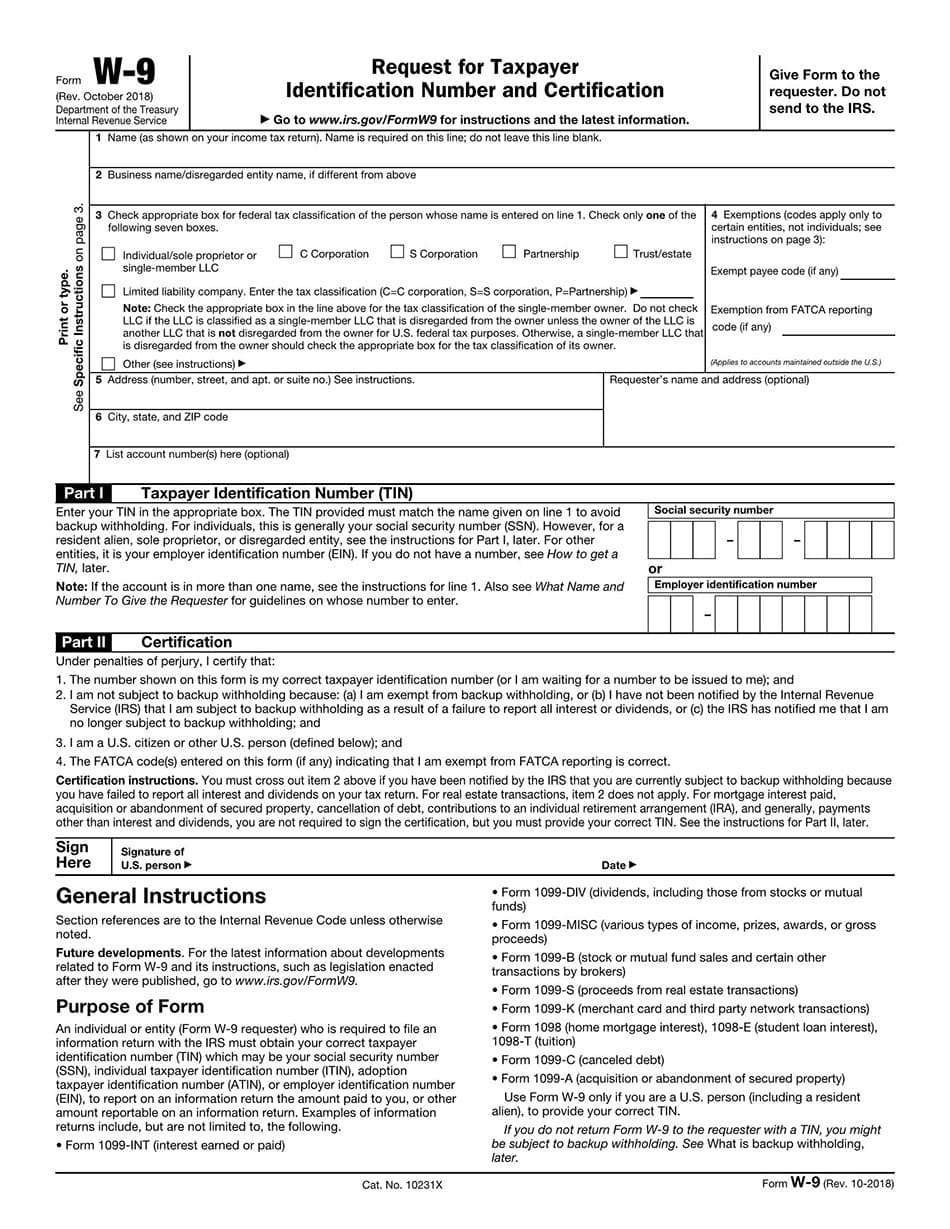

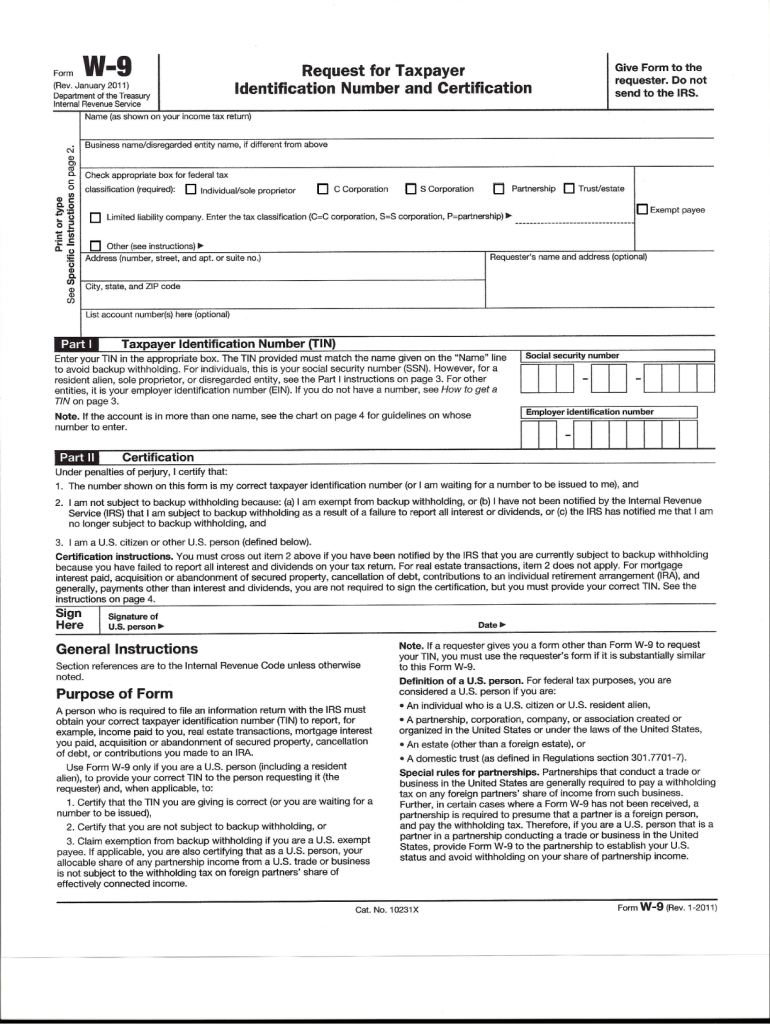

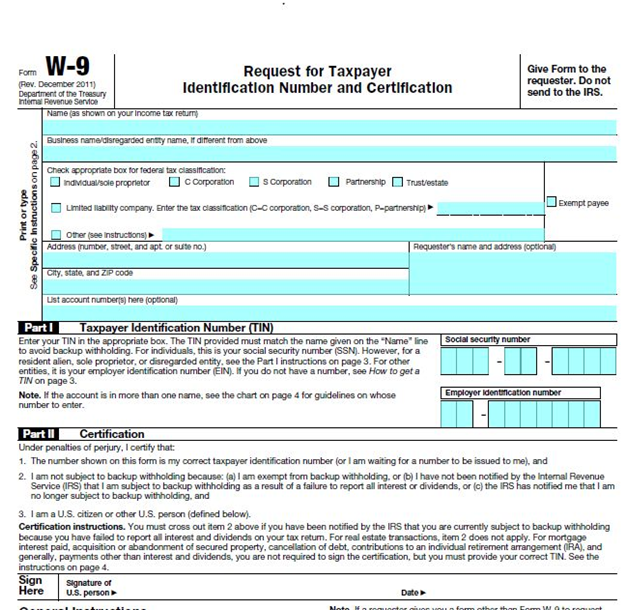

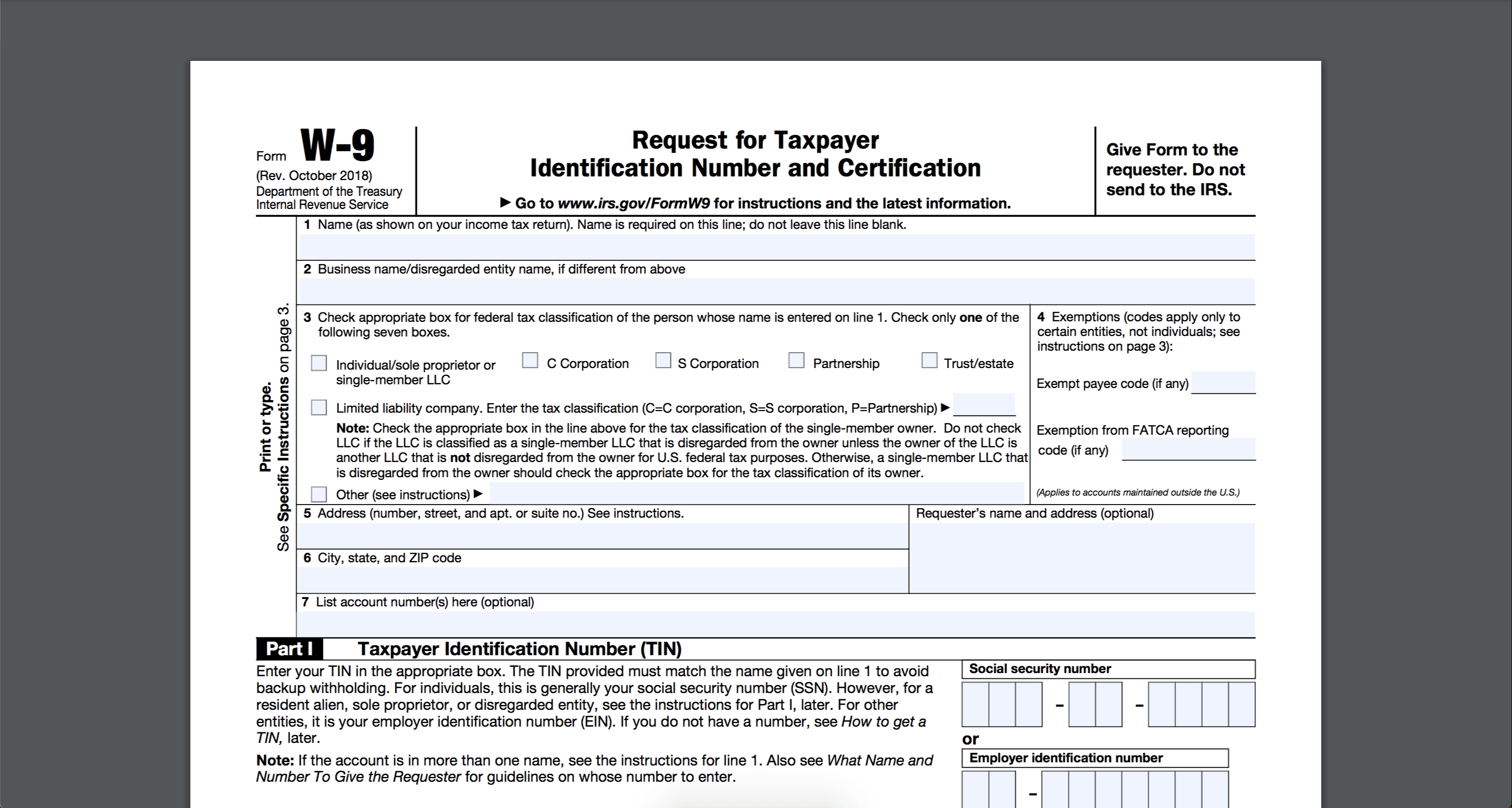

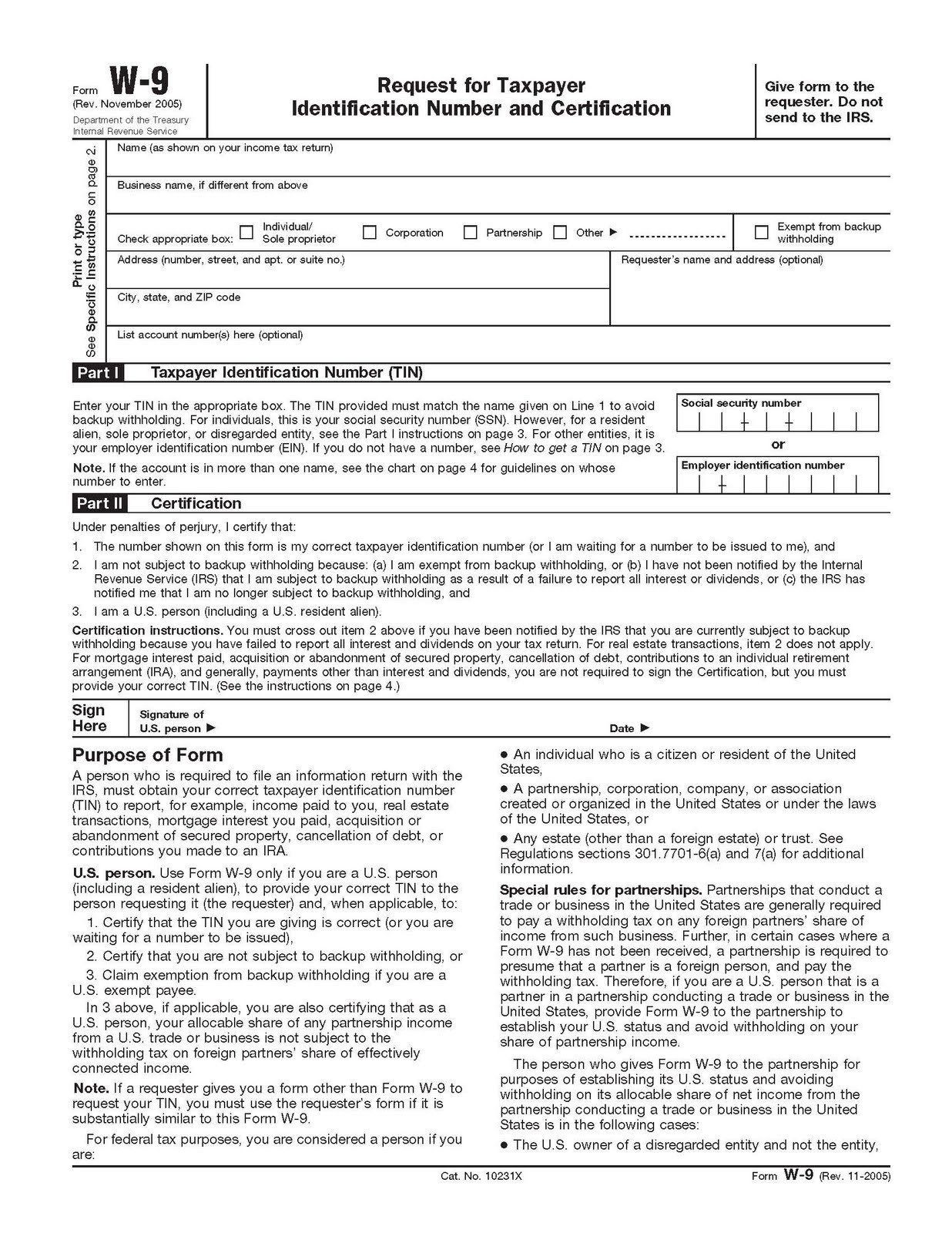

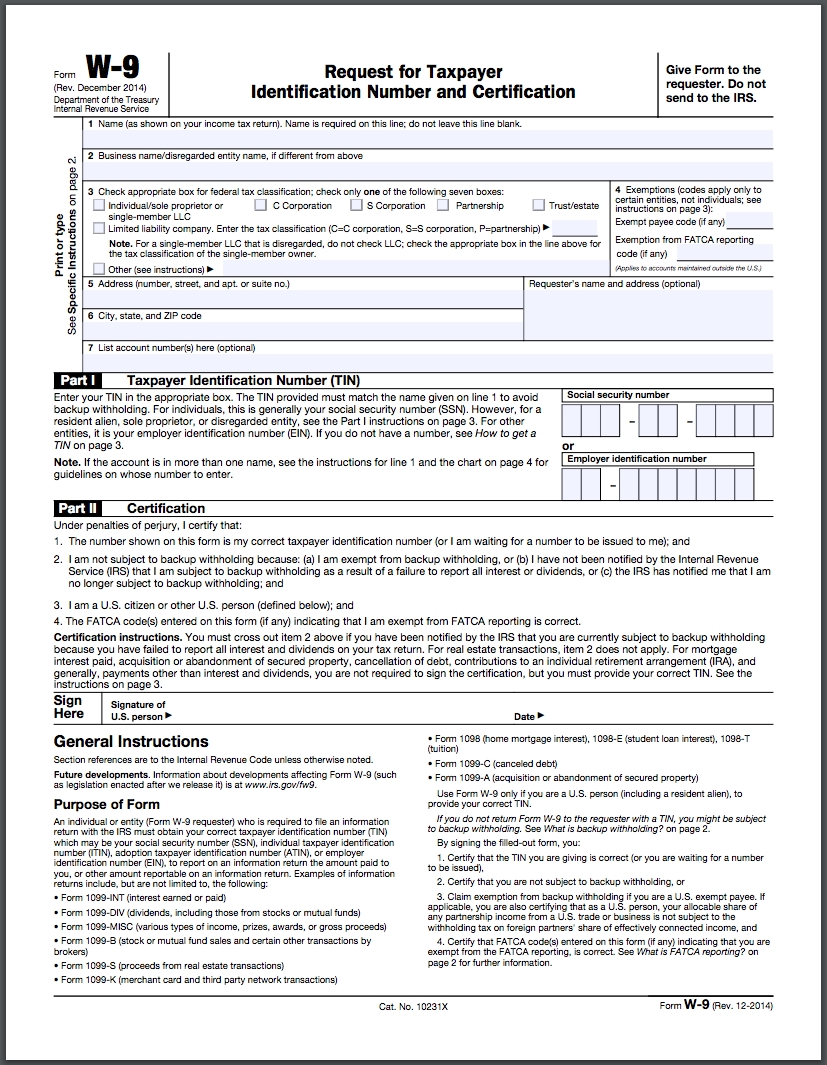

How to get a w 9 form. Only one box should be checked. Employers use this form to get the taxpayer identification number (tin) from contractors, freelancers and vendors. The first section of the form involves competing seven steps that involve your personal and business identification information.

Let them know that they must submit a. One of the most common situations is when someone works as an independent contractor for a business. The form is used to convey form 1099 information to taxpayers working as independent contracts in.

Print the form and then ask contractors to fill it out and give you a copy. Include any exemption codes, if applicable. The form also provides other personally identifying information like your name and address.

4 exemptions (codes apply only to certain entities, not individuals; Who needs to fill them out? 2 complete the basic information in section one.

You’ll complete part i next. Information about this common irs tax form. Do not send to the irs.

While that’s a mouthful, it’s a simple concept to understand. Exempt payee code (if any) limited liability company. Enter the tax classification (c=c.

Enter your city, state and zip in line 6. See instructions on page 3): Give form to the requester.

Write the business’ address (number, street and apartment number or suite number). 1 make sure you've got the right form. Enter your ssn, ein or.

You may receive the form from the client or company that hired you. What do you do with it? The form asks for information such as the ic's name, address, social security number (ssn), and more.

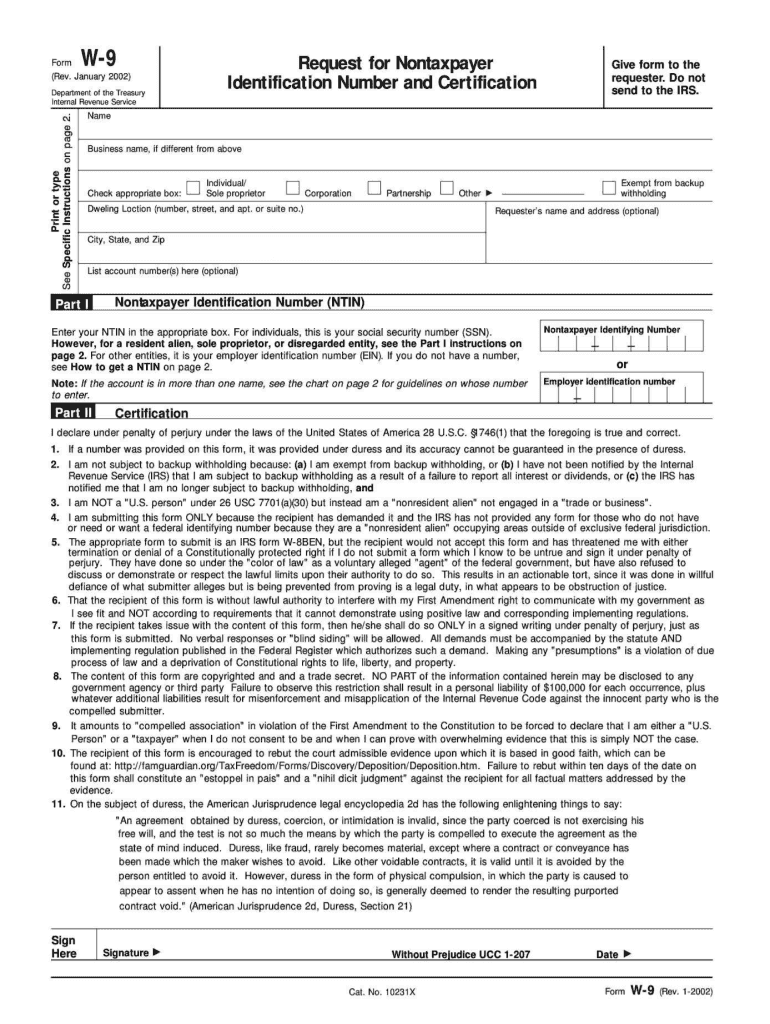

Person (including a resident alien) and to request certain certifications and claims for exemption. The informant, alexander smirnov, is “actively peddling new lies that could impact u.s. In most cases, you should receive any 1099 form by the.