Neat Tips About How To Keep A Personal Budget

Draw up a budget you can stick to.

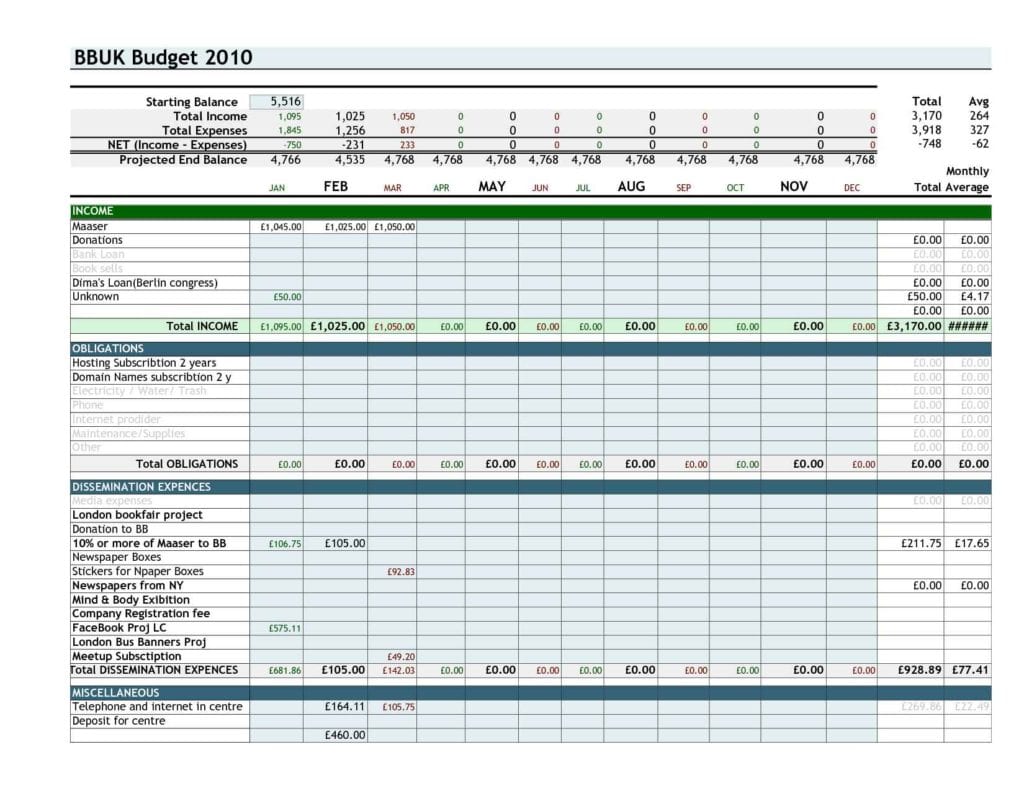

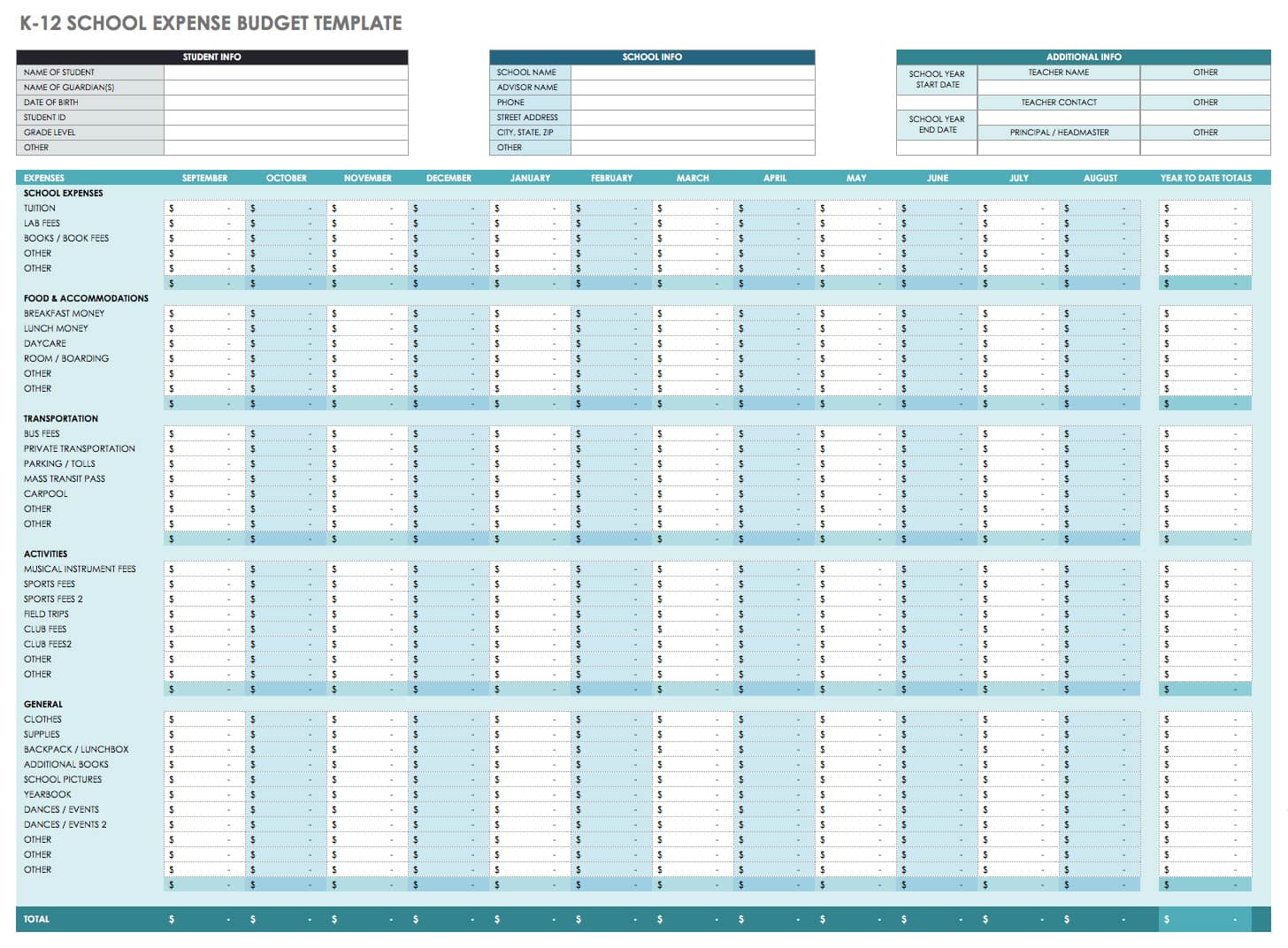

How to keep a personal budget. Your first steps should be deciding your financial goals,. | edited by barri segal | reviewed by tanza loudenback, cfp | nov. Gather bank statements, household bills and receipts.

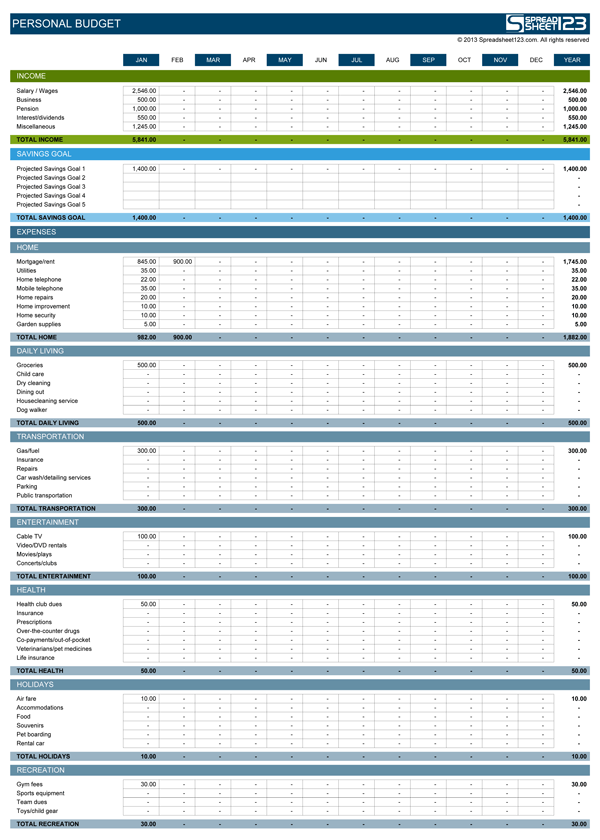

Set reminders for yourself 4. You figure out how much you have been spending. You plan for how much you will spend in the future.

Top tips for sticking to your budget. Ditch the credit cards 5. Cut the cost of your debts.

Create a budgeting schedule 3. Here are five pieces of advice from our authors on how to feel in control of your personal finances. Practical ways to manage costs and stay on top of.

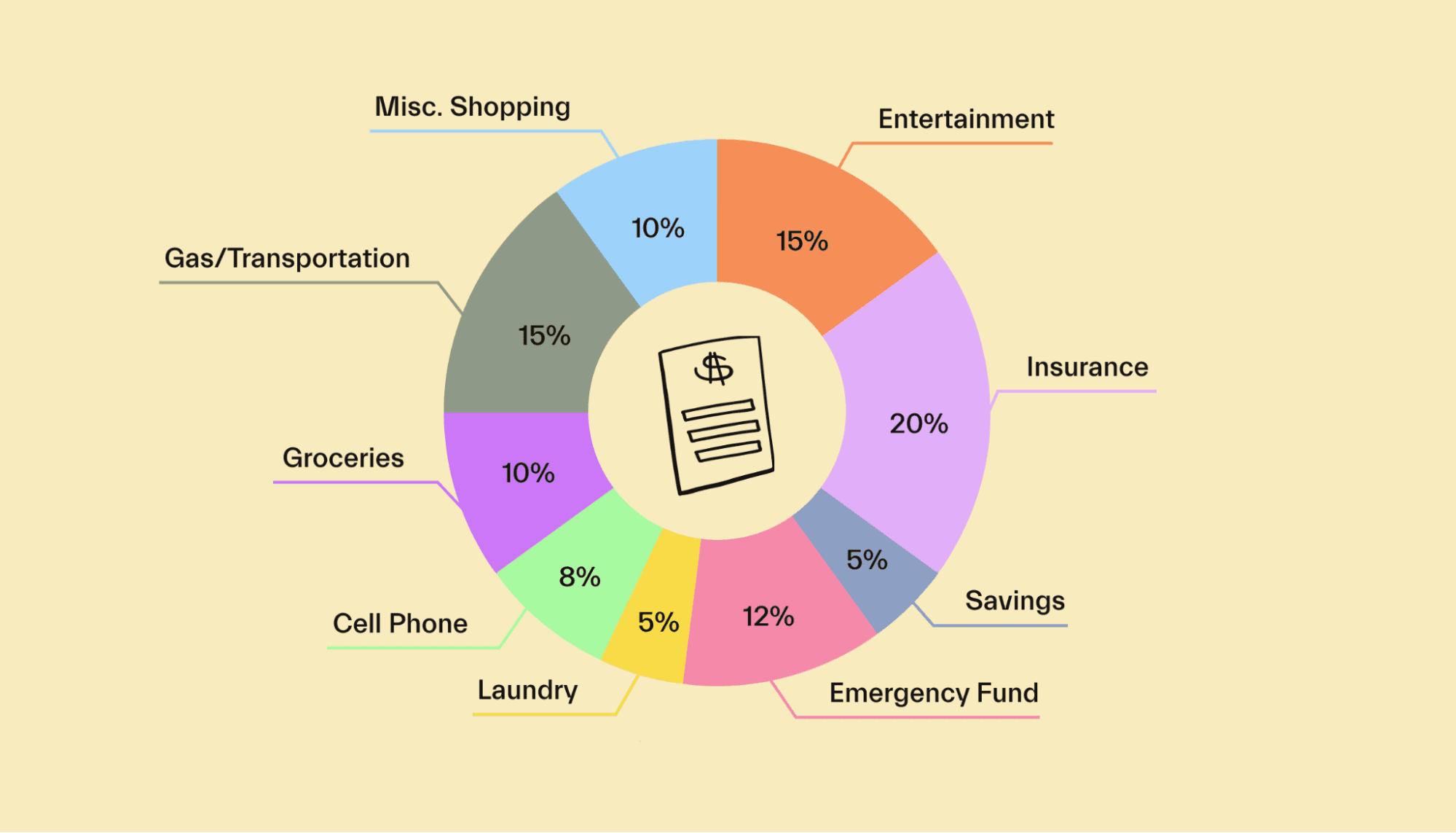

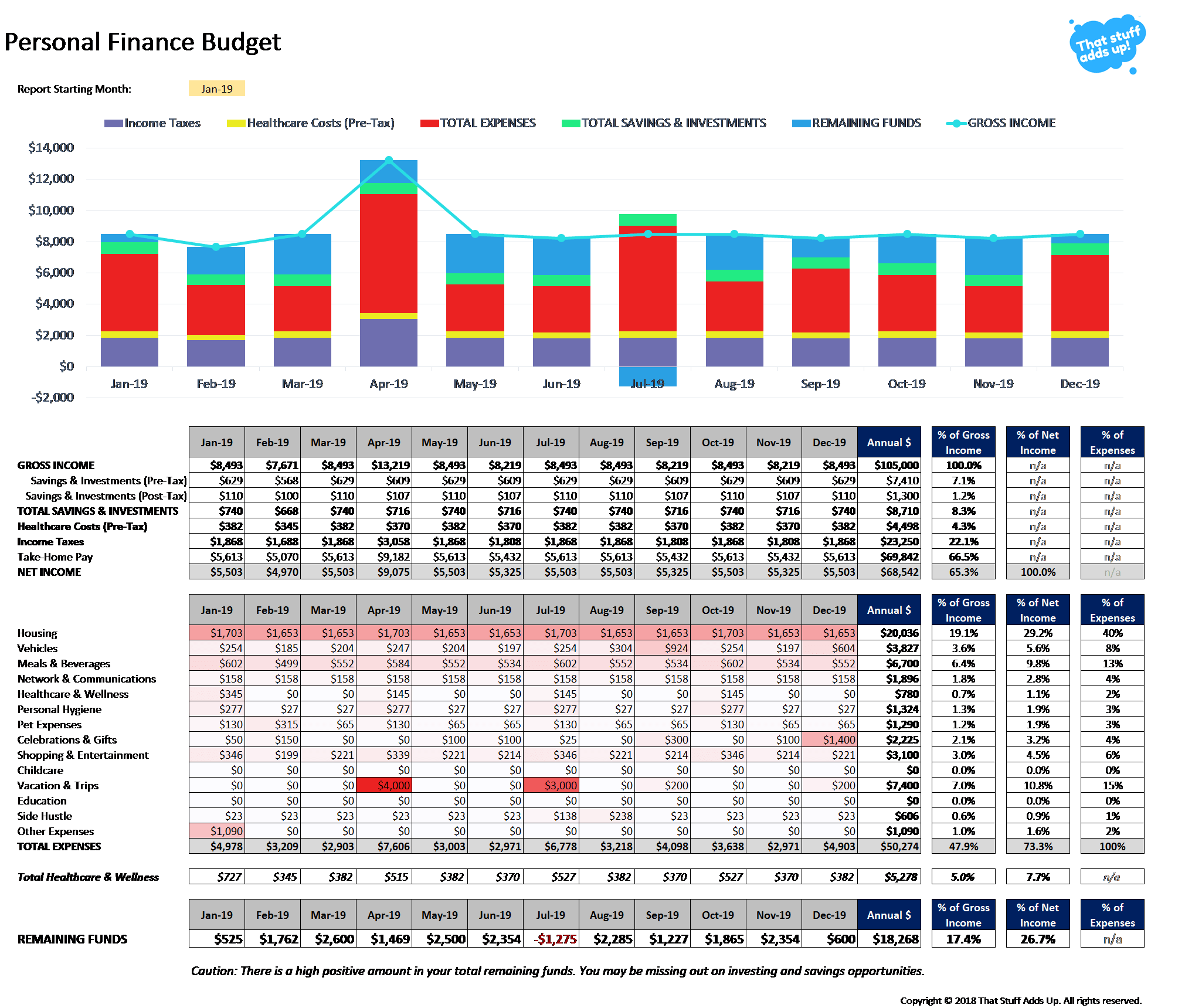

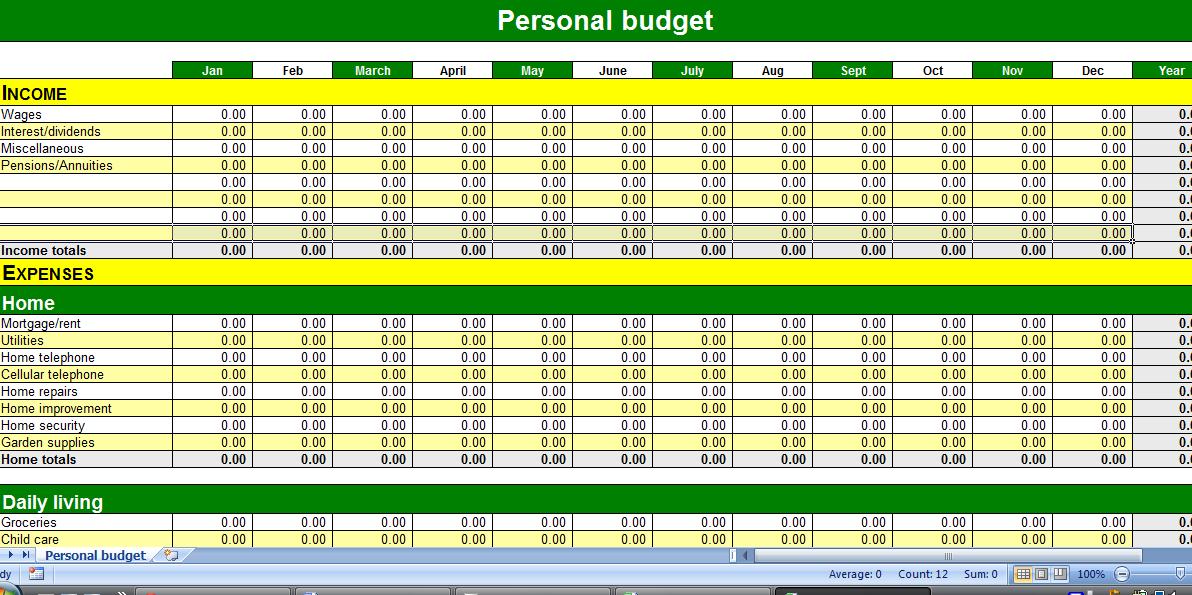

A personal budget helps you understand the flow of your money: Review your disposable income. So, how can you make a personal budget for yourself?

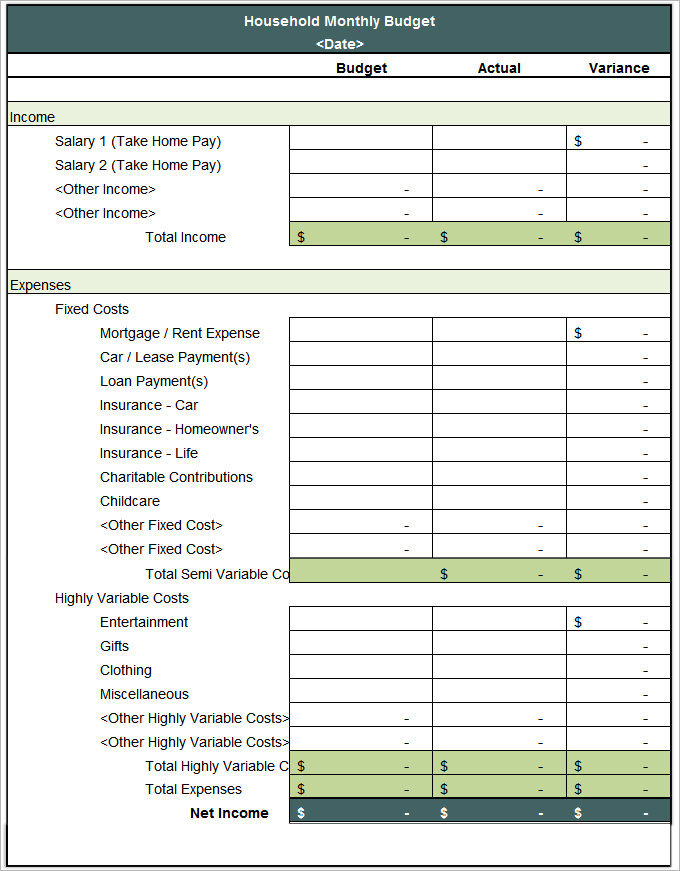

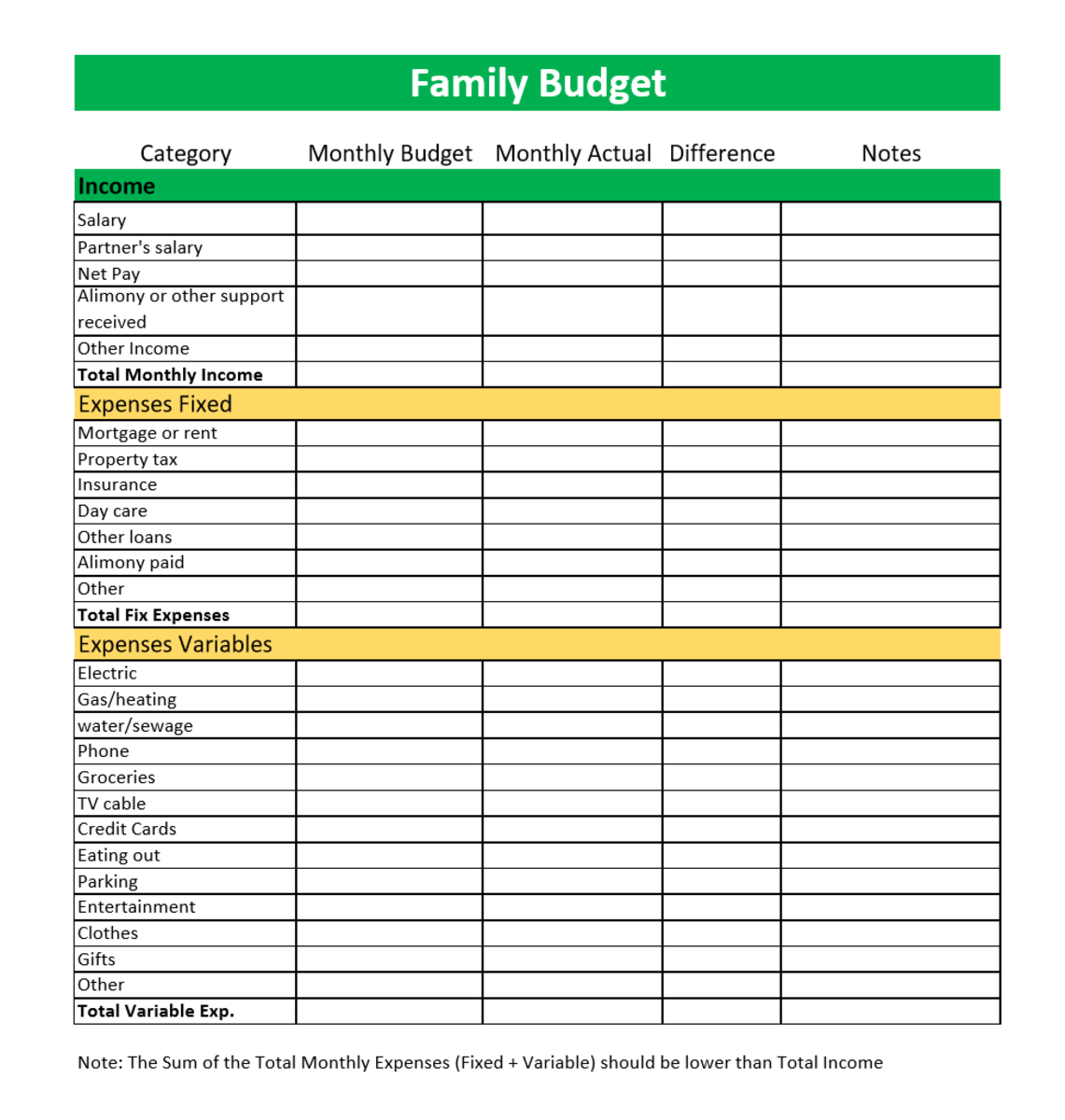

Up next in budgeting. List all of your fixed expenses step 3: Start by taking note of all of.

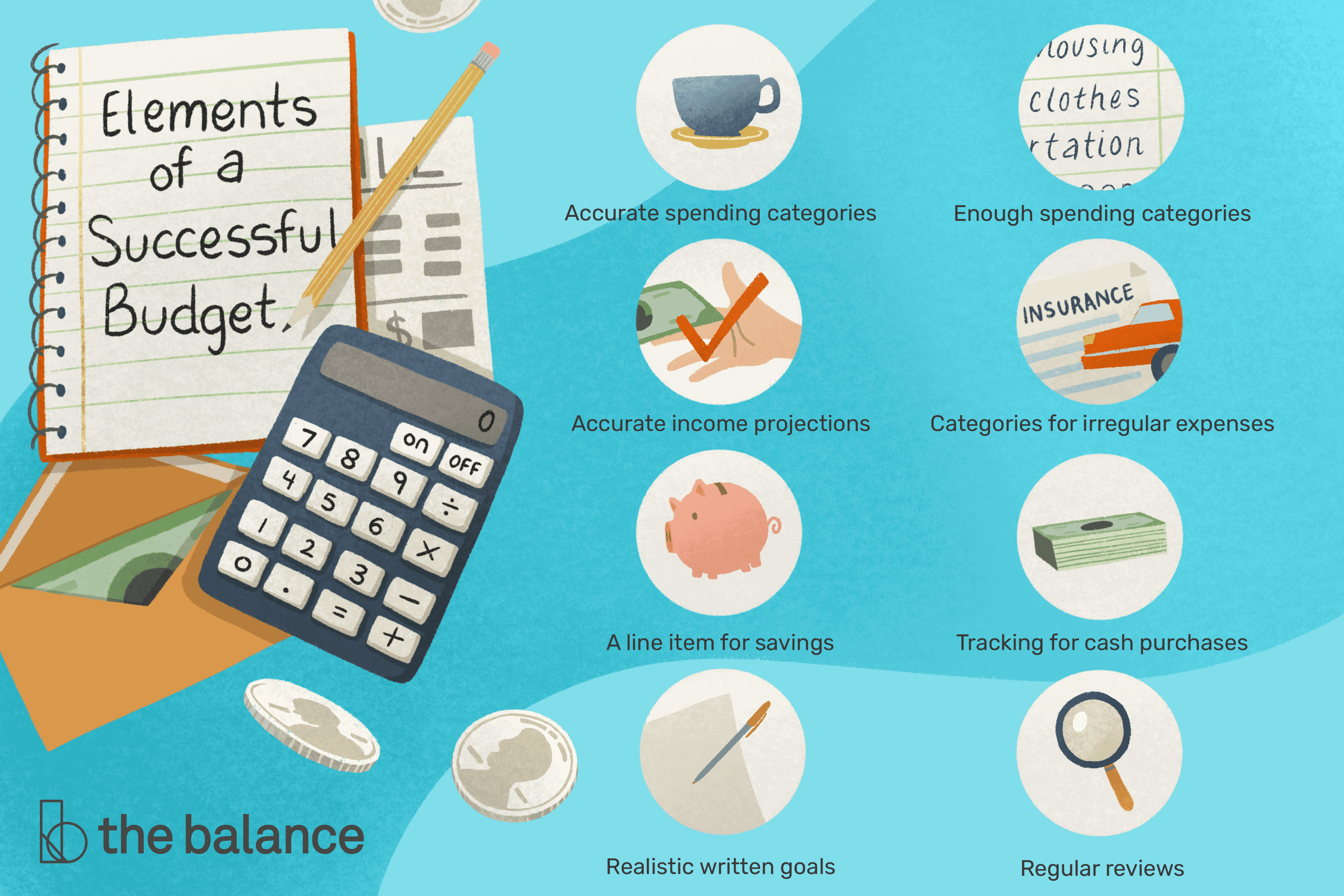

Creating a budget is a great way to track spending and an important step to getting your finances in order. Make you money matter more with an post money manager, the budgeting tool that lets you link all your accounts and keep. The more you can simplify your balance sheet — pay off your mortgage, get rid of credit card debt — the more freedom you’ll have to.

Examine your income to start budgeting, you first need a good pulse on your monthly income — more specifically, how much you take home each after taxes. Start by working out the least amount of money you need per month to literally keep the lights on:. You sit down with your accounts and receipts.

Pay your savings “bill” first. Let go of your limiting beliefs about money. Creating a budget involves several steps to help you understand and manage your personal finance effectively.

Spending tracker mint.com personal finance homebudget lite smart budget money for ipad free i didn’t have the chance to test them all out, so choosing. Getty images the idea is to organize your money according to your. Three steps to spend less and save more.