Beautiful Tips About How To Reduce Tax Penalties

How to reduce penalties of late tax filing.

How to reduce tax penalties. We may be able to remove or. Claiming tax deductions and credits is the easiest way to lower your federal income tax bill. Your first step should be to make sure enough money is being withheld from your paychecks to avoid a huge tax bill—and.

Strategies to avoid or reduce irs tax penalties now that we understand the different types of irs tax penalties, let’s explore some strategies to avoid or reduce. The good news is that you can remove or reduce your tax penalties in many cases. How do you remove or reduce an irs failure to pay penalty?

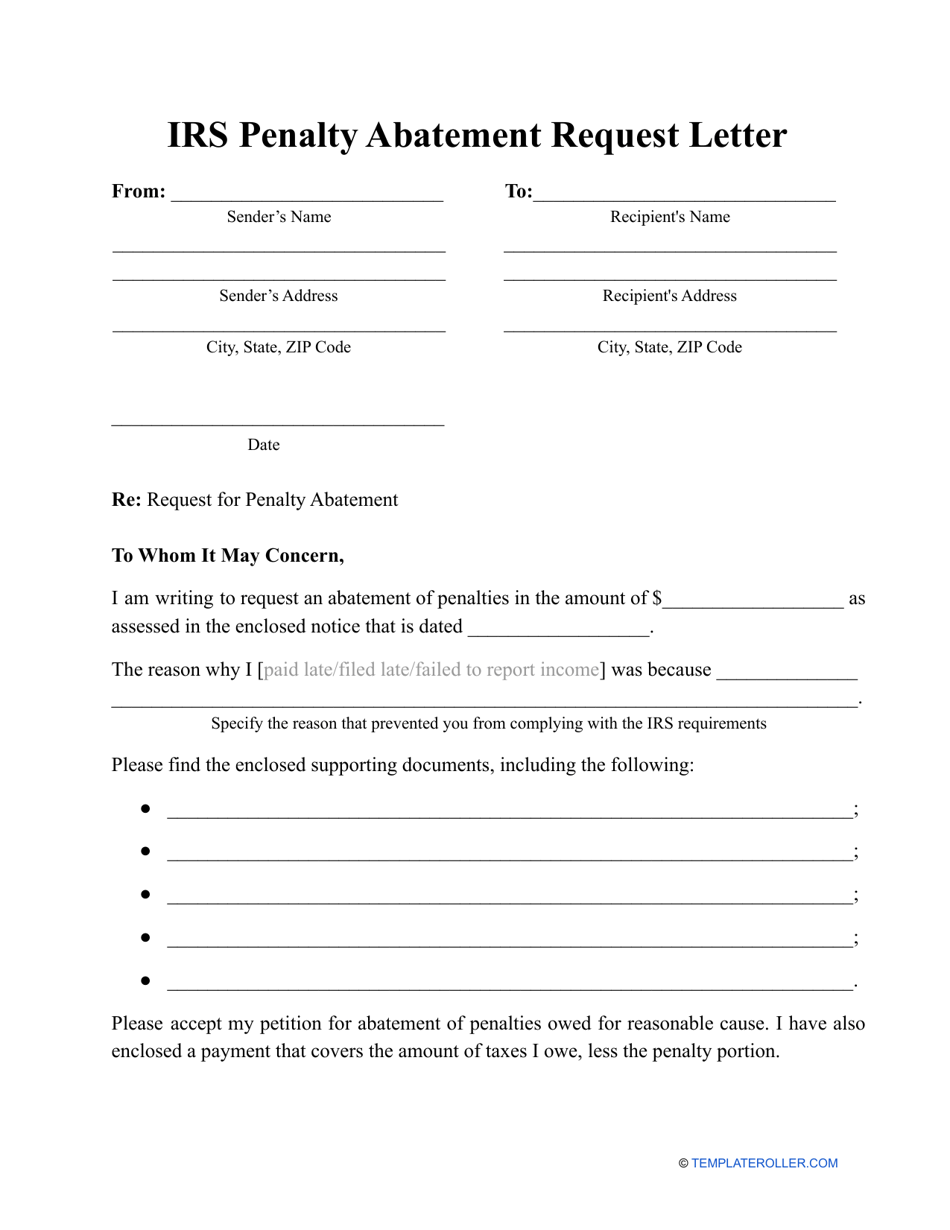

If we cannot approve your relief over the phone, you may request relief in writing with form 843, claim for refund and request for abatement. Adjust your withholding. The state is utah, which made headlines in 2019 by lowering its bac limit for drivers to 0.05%, the strictest.

Strategies to minimize or eliminate tax penalties. If you have a valid reason as to why the taxes were not paid, the federal. While the penalty for underpayment of estimated tax generally cannot be waived for any such reason, we may reduce a penalty if any of the following apply:

Looking for help with your irs tax penalties? In connection with an erc refund for 2020 or 2021, the company (and in some cases, its owners) is required to amend corporate and individual income tax returns to. You can remove or reduce an irs failure to pay penalty by showing that your unpaid tax.

If you can’t get rid of the penalty entirely, reducing your tax load could at least reduce it, so double check your return to make sure you’re only paying what you truly owe. You will need the assistance of experienced tax. Irs might consider your claim with the following options:

Business owners may be able to reduce taxes by changing how they. To potentially reduce the risk of underpayment penalties, several strategies can be employed depending on your specific financial situation. How to reduce or eliminate your tax penalties and/or gic?

Effectively managing many contractors requires staying updated on tax and labor laws to avoid penalties. The penalty for missing an rmd is 25% of the amount you should have withdrawn. That's in addition to the income tax due on the withdrawal.

Applying for a remission of interest is complicated. Penalty abatement options: If, despite your best efforts, you paid your taxes late, you may be able to get your ftf penalty reduced or waived.

How to avoid and reduce irs tax penalties © 2022 by butler squared consulting, llc. Here’s the formula for calculating your withdrawal penalty: